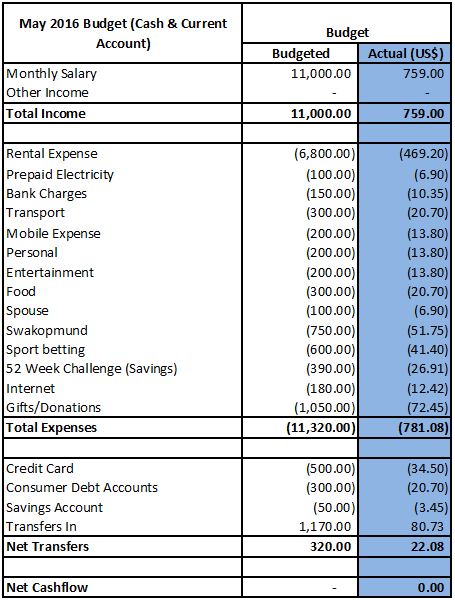

This month is going to be a very tough month. May is a big month. May always seems to be the turning point of my year. By May, I already have a feel for what the year is going to be like and May also determines how the rest of the year will be like. This month, for the first time, I have my budget ready on time.

We are going to a wedding at the coast. Traveling expenses, accommodation expenses and entertainment expenses go up. I’ve budgeted $750 for our trip to the beach which is this coming weekend.

May means the end of the English Premier League season (and most European football leagues). I made a couple of bets with some friends and I need to account for the losses I could potentially take on. I know I should have made a provision for this earlier this year, but it really looked like I wasn’t going to lose the wager. Lesson learned.

It’s my wife’s birthday this month, so I need to budget for that as well. Even though I should actually pay for her gifts with the next paycheck, but I get that paycheck a day before her birthday. I need more time to prepare for her birthday. So my savings fund is going to take a big hit this month. Hopefully I can refill it over the coming months.

My budget for other expenses is really tight this month. A lot of the expenses like food, entertainment, personal and mobile expenses are lower than their average monthly actual in the first quarter of the year. I have no choice but to keep it tight this month because I am already taking $1200 from my saving just to make it through this month.

I expect to come into some cash later this year, so even though my savings is going to plummet, lowering my net worth, it will pick up later this year. Also, my wife and I’ve been saving for a trip to Durban, South Africa with her family, but it seems the trip might be called off. We have an extra fund of cash for any emergencies now. Maybe we might decide to go on holiday after all with that money, but I like knowing there is extra cash if s*** hits the fan.

Well, this should be an interesting month, not only with regard to money. This month marks the end of the football season, the start of my school exams and the end of a financial year at work. I hope I can survive May.

Until next time. Thanks for reading.